| | LAS VEGAS SANDS 2023 Proxy Statement | | 25 In accordance with applicable rules of the NYSE and the Company’s Corporate Governance Guidelines, the Board has adopted a policy to meet at each regularly scheduled Board meeting in executive session without management directors or any members of the Company’s management being present. In addition, the Board’s independent directors meet at least once each year in executive session. At each executive session, a presiding director chosen by a majority of the directors present presides over the session.

LAS VEGAS SANDS CORP.• 2021 PROXY STATEMENT 27

Stockholder Communications with the Board

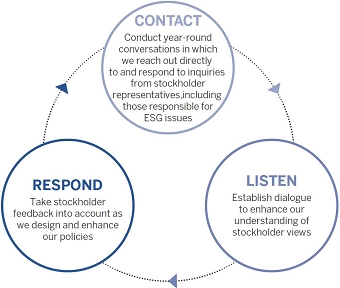

STOCKHOLDER COMMUNICATIONS WITH THE BOARD Stockholders and interested parties who wish to contact our Board, the Chairman of the Board, the presiding non-management director of executive sessions or any individual director are invited to do so by writing to: Board of Las Vegas Sands Corp. c/o Corporate Secretary 3355 Las Vegas Boulevard South5500 Haven Street

Las Vegas, Nevada 89109 89119 Complaints and concerns relating to our accounting, internal control over financial reporting or auditing matters should be communicated to the Audit Committee using the procedures described below. All other stockholder and other communications addressed to our Board will be referred to our presiding non-management director of executive sessions and tracked by the Corporate Secretary. Stockholder and other communications addressed to a particular director will be referred to that director. Stockholder Communications with the Audit Committee

STOCKHOLDER COMMUNICATIONS WITH THE AUDIT COMMITTEE Complaints and concerns relating to our accounting, internal control over financial reporting or auditing matters should be communicated to the Audit Committee, which consists solely of non-employee directors. Any such communication may be anonymous and may be reported to the Audit Committee through the Office of the General Counsel by writing to: Las Vegas Sands Corp. 3355 Las Vegas Boulevard Southc/o Audit Committee of the Board of Directors

5500 Haven Street Las Vegas, Nevada 8910989119 Attention: Office of the General Counsel All communications will be reviewed under Audit Committee direction and oversight by the Office of the General Counsel, the Audit Services Group, which performs the Company’s internal audit function, or such other persons as the Audit Committee determines to be appropriate. Confidentiality will be maintained to the fullest extent possible, consistent with the need to conduct an adequate review. Prompt and appropriate corrective action will be taken when and as warranted in the judgment of the Audit Committee. The Office of the General Counsel will prepare a periodic summary report of all such communications for the Audit Committee. LAS VEGAS SANDS CORP.• 2021 PROXY STATEMENT 28

| | | | | | | | 26 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

| EXECUTIVE OFFICERS |

EXECUTIVE OFFICERS This section contains certain information about our current executive officers, including their names and ages (as of the mailing of these proxy materials), positions held and periods during which they have held such positions. There are no arrangements or understandings between our officers and any other person pursuant to which they were selected as officers. Name | Age | Title | | | | | | | NAME | | AGE | | TITLE | | | | | Robert G. Goldstein | 65 | 67 | | Chairman of the Board,and Chief Executive Officer and Treasurer | | | | | Patrick Dumont | 46 | 48 | | President and Chief Operating Officer | | | | | Randy Hyzak | 51 | 53 | | Executive Vice President and Chief Financial Officer | | | | | D. Zachary Hudson | 41 | 43 | | Executive Vice President, Global General Counsel and Secretary |

On January 26, 2021, the Board appointed Mr. Goldstein as Chairman and Chief Executive Officer, Patrick Dumont as President and Chief Operating Officer and Randy Hyzak as Executive Vice President and Chief Financial Officer. Mr. Goldstein had been appointed Acting Chairman and Acting Chief Executive Officer on January 7, 2021, when Mr. Adelson took a medical leave of absence. Mr. Adelson passed away on January 11, 2021.

For background information on Messrs.Mr. Goldstein and Mr. Dumont, please see “Board.“Board of Directors Nominees.” Mr. Hyzak has been our Company’s Executive Vice President and Chief Financial Officer since January 26, 2021 and was our Senior Vice President and Chief Accounting Officer since March 2016, when he joined the Company. Prior to joining our Company, Mr. Hyzak served as Vice Presidentvice president and Chief Accounting Officerchief accounting officer at Freescale Semiconductor, Inc., a global semiconductor company, from February 2009 to March 2016, and served in other finance and accounting leadership capacities there, including as corporate controller. Prior to joining Freescale in February 2005, Mr. Hyzak was a senior manager with the public accounting firm Ernst & Young LLP where he primarily served large global Fortune 500 clients working in its assurance and advisory services practice from 1994 through early 2005. Mr. Hudson has been our Company’s Executive Vice President, Global General Counsel and Secretary since September 2019. Prior to joining our Company, Mr. Hudson served as executive vice president, general counsel and corporate secretary for Afiniti, an applied artificial intelligence company, from April 2016 through September 2019, and was an associate and then counsel at Bancroft PLLC, a law firm, from November 2011 to April 2016. Mr. Hudson served as a law clerk to U.S. Supreme Court Chief Justice John Roberts from 2010 to 2011 and to Justice Brett Kavanaugh in the U.S. Court of Appeals for the D.C. Circuit from 2009 to 2010. Prior to attending law school, Mr. Hudson served in the United States Navy, on the USS Santa Fe, as Lieutenant – Assistant Engineer. LAS VEGAS SANDS CORP.• 2021 PROXY STATEMENT 29

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 27 |

|  | COMPENSATION DISCUSSION AND ANALYSIS |

COMPENSATION DISCUSSION AND ANALYSIS The following discussion and analysis contains statements regarding Company performance objectives and targets. These objectives and targets are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply these statements to other contexts. This discussion supplements the more detailed information concerning executive compensation in the tables and narrative discussion that follow under “Executive Compensation and Other Information.” This Compensation Discussion and Analysis section discusses our compensation philosophy and objectives and the compensation policies and programs for the following individuals who are referred to as our “named executive officers” for 2020: (1) | Mr. Adelson passed away January 11, 2021. |

We also included in the following discussion, the new employment agreements the Company has entered into with each of its current executive officers in March 2021, in connection with the execution of the leadership succession planning previously discussed.2022:

— | 2020 ACCOMPLISHMENTS | | | | | | | ∎ | | ∎ | | ∎ | | ∎ | | | | | ROBERT G. GOLDSTEIN Chairman and

Chief Executive Officer | | PATRICK DUMONT President and

Chief Operating

Officer | | RANDY HYZAK Executive Vice

President and Chief

Financial Officer | | D. ZACHARY HUDSON Executive Vice President,

Global General Counsel and

Secretary |

— 2022 KEY ACCOMPLISHMENTS & FINANCIAL RESULTS In fiscal 2020, our financial performance was significantly impacted by the challenges faced in each of our operating jurisdictions as a result of the COVID-19 Pandemic. During this time, our primary focus has been the safety and well-being of our Team Members and patrons, and on supporting the communities in which we operate. Despite the challenges caused by the COVID-19 Pandemic,reduction in travel and tourism spending in Asia over the last three years, we have continued to execute on our short and long-term operational and strategic objectiveobjectives of growingensuring the business by investingbest possible preparation and positioning for our operating recovery in Asia and allocating capital to projects we believe will produce a high return on invested capital in our industry-leading Integrated Resorts in Macao and Singapore. TheA number of the key accomplishments by our senior management team during 2020 included:2022 included the following important operational and strategic initiatives:

Navigated the COVID-19 Pandemic while fully supporting| • | | Prepared our operations for travel and tourism spending recovery |

As travel patterns began to recover and visitation increased, our Team Members by forgoing furloughs and layoffs and maintaining steady paychecks and health benefits; Developed and implementedadjusted property EBITDA at MBS in Singapore was positive in all four quarters of 2022. On a hold-normalized basis, our re-opening strategy for our operating propertiesadjusted property EBITDA at MBS increased sequentially in each jurisdiction, putting in place new protocols and procedures to limit the spread of the virussecond, third and protectfourth quarters of 2022. Our ability to achieve that pace of recovery required considerable planning, preparation, adaptation and execution across our MBS operations. Of equal importance throughout 2022 was our executive team’s preparation for the well-beingreturn of our Team Memberstravel and patrons;

Mitigated the COVID-19 Pandemic’s impact on our liquidity through the issuance of $1.50 billion of SCL senior unsecured notes, securing the option to draw an additional $1.0 billion on our SCL credit facility, amending each of our SCL, Singapore and U.S. credit facilities to waive the requirements to comply with certain financial covenants through and including December 31, 2021, and implementing certain cost reduction programs;

Progressed construction in connection with the ongoing $2.2 billion investment programtourism spending in Macao includingduring 2023.| • | | Continued capital investment in our most important markets |

In 2022, we completed the renovation, expansion and rebrandingremainder of Sands Cotai Central intothe initial phases of investments in the creation of The Londoner Macao, significantly enhancing the positioning of our Macao property portfolio in anticipation of the recovery in travel and tourism spending in that region. We also made substantial progress on the ~$1.0 billion renovation of MBS, which began its phased opening in 2020will introduce new world-class suites and will continue through 2021;luxury tourism offerings and Enhanced our diversity and inclusion efforts through substantially enhance the implementation of a new DEI charter and creation of a DEI advisory council.

overall guest experience for premium customers. | • | | Completed sale of Our Las Vegas Operating Properties |

The successful sale of our Las Vegas operations and assets for an aggregate purchase price of $6.25 billion, enhanced our balance sheet strength and liquidity as we prepared for the recovery of travel and tourism spending in Asia and allowed us to continue to invest meaningfully in our Macao and Singapore markets and pursue future growth opportunities in new markets. The sale process was successfully concluded in February 2022. | • | | Secured a new ten-year gaming concession in Macao |

We were gratified to receive a new ten-year gaming concession in Macao, providing us the opportunity to continue our 20-year track record of investment in Macao and to enhance Macao’s business and leisure tourism appeal. Our successful tender for one of the six available licenses represents a very significant milestone reached in the attainment of our long-term strategic objectives. | | | | | | | | 28 | | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT2023 Proxy Statement | 30 |

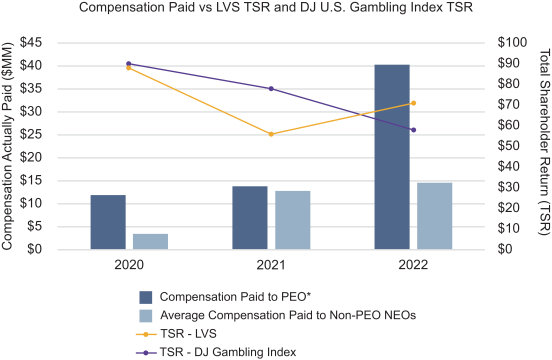

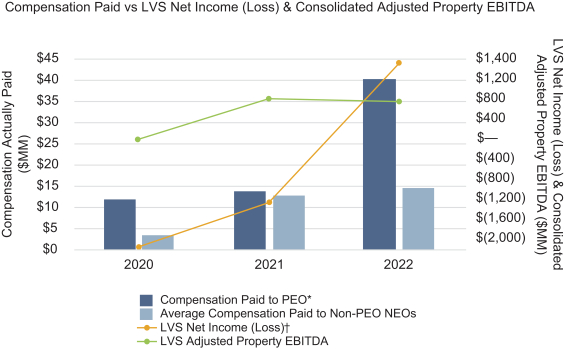

COMPENSATION DISCUSSION AND ANALYSIS The Company’s 20202022 financial performance results include:included:

| | | | | | | | | | | | | | | | | | $4.11B | | Consolidated Net Revenue | | $1.54B | | Consolidated Net Loss From ContinuingOperations | | $732M | | Consolidated AdjustedProperty EBITDA from continuing operations(1) |

| (1) | Refer to Annex A, which includes a reconciliation of non-GAAP consolidated adjusted property EBITDA to net loss.loss from continuing operations. |

— COMPENSATION BEST PRACTICES Our executive compensation program reflects many best practices: — | OBJECTIVES OF OUR EXECUTIVE COMPENSATION PROGRAM | | | | | | | | | | | | WHAT WE DO | | | | WHAT WE DON’T DO | | | | | | ✓ | | Provide the opportunity for stockholders to vote on the advisory “say-on-pay” proposal on an annual basis | | | |

| | No supplemental executive retirement plans | | | | | | ✓ | | Maintain a clawback policy for our cash and equity incentive awards | | | |

| | No guaranteed bonuses | | | | | | ✓ | | Utilize short-term and long-term performance-based incentives | | | |

| | No repricing of stock options | | | | | | ✓ | | Fully disclose our incentive plan performance measures | | | |

| | No “golden parachute” excise tax gross ups | | | | | | ✓ | | Align our executive compensation structure with the interests of our stockholders | | | |

| | No “single-trigger” vesting or benefits solely upon the occurrence of a change in control | | | | | | ✓ | | Provide for a majority of executive compensation that is at-risk and tied to the Company’s performance | | | |

| | Provide for annual equity compensation for executive officers that does not have a performance-based element | | | | | | ✓ | | Retain an independent executive compensation consultant | | | | | | | | | | | | ✓ | | Include ESG metrics in our performance-based compensation | | | | | | |

— OUR EXECUTIVE COMPENSATION PROGRAM Objectives of Our Executive Compensation Program We design our executive compensation program to drive the creation of long-term stockholder value. We do this by tying compensation to the achievement of performance goals that promote creation of stockholder value and by designing compensation to attract and retain high-caliber executives in a competitive market for talent. Our executive compensation program is overseen by the Compensation Committee, which has developed an executive compensationthe program to accomplish the following primary objectives: Attract and retain key executive talent to support the Company’s strategic growth priorities and culture;

Maximize long-term stockholder value through alignment of the compensation and interests of the executive officers with those of our stockholders;

Reward the executive officers by aligning their compensation with the achievement of Company financial objectives and their individual performance goals with our strategic objectives; and

Promote good corporate citizenship in our executive officers.

| • | | Attract and retain key executive talent to support our strategic growth priorities and culture |

| • | | Maximize long-term stockholder value through alignment of the compensation and interests of the executive officers with those of our stockholders, including by granting equity-based compensation in the form of restricted stock units and stock options that incentivize growing our business in ways that drive stock price appreciation over the long term |

| • | | Reward the executive officers by aligning their compensation with the achievement of our financial and strategic objectives |

| • | | Promote good corporate citizenship in our executive officers |

| | | | | | | |

| | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT2023 Proxy Statement | 31 |

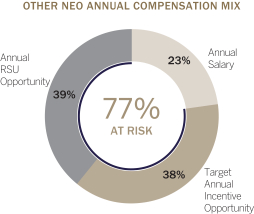

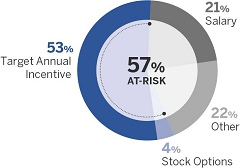

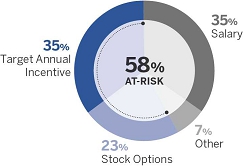

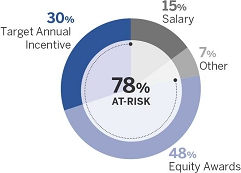

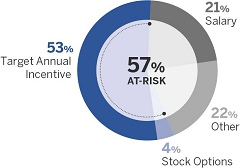

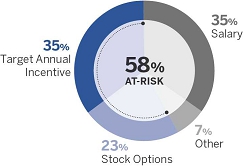

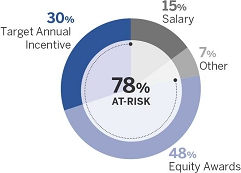

The above annual compensation mix is based on the employment agreement of each named executive officer and reflects the following: —• | ELEMENTS OF EXECUTIVE OFFICER COMPENSATION | Target annual incentive denotes annual cash bonus and assumes “at target” achievement of goals; and |

| • | | Excludes benefits such as security, personal aircraft usage and health coverage. |

In 2020,The amounts represented above are the contractual annual amounts pursuant to these employment agreements. Actual amounts earned may differ for the year.

The principal components of total direct compensation and their key objectives for theour named executive officers are set forth below: Base Salary set by the Compensation Committee in employment agreements to reflect job responsibilities and to provide competitive fixed pay to balance performance-based compensation;

Annual Cash Bonus is structured to align to our global financial execution with adjusted property EBITDA targets established annually by the Compensation Committee, taking into consideration the annual budget approved by the Board. The targets are designed to provide the ability to continue our investment and development initiatives and increase stockholder returns;

Equity Awards are granted by the Compensation Committee to provide incentives to create and sustain longer-term growth in stockholder value; and

Personal Benefits are provided to allow our executives to effectively and efficiently focus on their Company roles and responsibilities.

Compensation Mix: 2020 Actual

CEO COMPENSATION MIX• | OTHER NEO COMPENSATION MIX | | | |  |  Base Salary is set by the Compensation Committee in employment agreements to reflect job responsibilities and to provide competitive fixed pay to balance performance-based compensation. |

Note:• | Target Annual Incentive denotes bonus | Short-Term Incentives (Annual Cash Bonus) are structured to align to our global financial and Non-Equity Incentive Plan compensation; Other denotes 401(k), life and disability insurance, health care insurance, security, airfare and other benefits. Stock option related compensation represents the expense incurredoperational execution with targets established annually by the Company forCompensation Committee, taking into consideration the respective executive officers forannual budget approved by the year ended December 31, 2020, as determined pursuantBoard. The targets are designed to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. |

Illustration of Compensation Mix Under New Employment Agreements

New employment agreements were implemented with our executive officers in March 2021. The new agreements are designed to reduce the salary component as a proportion of overall compensation and increase the proportion of equity and at-risk components. We also expanded our performance metrics to include ESG factors as well as financial performance for both equity and non-equity incentive compensation. The following pro-forma illustrations demonstrate the approximate impact of these new agreements on the elements of executive compensation.

CEO COMPENSATION MIX | OTHER NEO COMPENSATION MIX | | |  |  |

Note: The above illustration for the 2021 employment agreements reflect the following:

| • | Assumes “at target” achievementencourage the continuation of goals for all performance-based compensation | | • | Reflects the full impact of multi-year equity compensation components at target | | • | Excludes equity granted outside of annual performance-based program | | • | Other compensation has been estimated based on historic compensation costs associated with each individualour investment and development initiatives and increase stockholder returns. |

LAS VEGAS SANDS CORP.•2021 PROXY STATEMENT | 32 |

— | THE PROCESS OF SETTING EXECUTIVE COMPENSATIONLong-Term Incentives (Annual Equity Awards) are granted by the Compensation Committee to provide incentives to create and sustain longer-term growth in stockholder value and are structured to align to our global financial and operational execution with targets established annually by the Compensation Committee, taking into consideration the annual budget approved by the Board. From time to time in its discretion, the Compensation Committee may also approve one-time equity grants. |

| • | | Personal Benefits are provided to allow our executives to effectively and efficiently focus on their roles and responsibilities. |

The Process of Setting Executive Compensation We have entered into employment agreements with Messrs. Adelson,Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson. TheThese employment agreements provide the overall framework for the compensation for theseour named executive officers, including base salary, target bonus amounts and equity-based awards. The Compensation Committee approved the compensation packages for Messrs. Adelson,Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson at the time we entered into their respective employment agreements and any amendments thereto and approved all bonuses and equity awards granted during the terms of these agreements and the period in which each of these individuals has served as an executive officer. agreements. The Compensation Committee believes that most of the compensation for named executive officers should be at risk and tied to a combination of short-term Company performance and long-term stockholder value creation. As indicated above, 57%84% and 58%77% of the compensation of Mr. AdelsonGoldstein and our other named executive officers, respectively, varies with either short-term or long-term Company performance. In establishing a mix of fixed and variable compensation, the Compensation Committee seeks to maintain its goal of making the majority of compensation tied to performance, while also affording compensation opportunities that, in success, would be competitive with alternatives available to the executive. Furthermore, when determining the compensation structure for Mr. Adelson, the Compensation Committee took into consideration his position as the majority stockholder of the Company through his and his family’s stock ownership. Because Mr. Adelson’s stockholdings served to align his interests with other stockholders, his compensation structure was designed to principally provide non-equity linked compensation. The Compensation Committee believes at-risk compensation provides theour named executive officers with clear objectives to meet annual financial targets and to continue the historical execution of our strategic objectives of growing our operations by | | | | | | | | 30 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

COMPENSATION DISCUSSION AND ANALYSIS continued investment in our Integrated Resort properties and increasing returns to stockholders, while also aligning the equity component of compensation to the creation of long-term stockholder value. Specifically, the Compensation Committee believes that granting equity-based compensation in the form of restricted stock units and stock options, upon meeting annual financial and performance targets, incentivizes management to continue to grow our business in ways that drive stock price appreciation over the long term. — | COMPENSATION BEST PRACTICES |

As previously noted in “Stockholder Engagement” we have received input from investors regarding the compensation framework for our named executive officers. The primary focus of the feedback related to the long-term incentives under the employment agreements of our named executive officers, specifically the performance criteria associated with the long-term incentives being measured over only one year versus over multiple years. The Compensation Committee acknowledges the feedback, but currently considers the current one-year measurement period to be appropriate, taking into consideration the impact of COVID-19 in Asia on the Company’s operations in Macao and Singapore since February 2020. OurIn establishing the compensation for all named executive compensation program reflects many best practices:officers, other than the CEO, the Compensation Committee considers the recommendations and input of the CEO. The CEO performs annual performance reviews of the other named executive officers and makes recommendations to the Compensation Committee. The Compensation Committee considers these recommendations and ultimately makes the final decision.

WHAT WE DO | | WHAT WE DO NOT DO |  | Provide the opportunity for stockholders to vote on the advisory “say-on-pay” proposal on an annual basis | |  | No supplemental executive retirement plans |  | Maintain a clawback policy for our cash and equity incentive awards | |  | No guaranteed bonuses |  | Utilize short-term and long-term performance-based incentives/measures | |  | No repricing of stock options |  | Fully disclose our incentive plan performance measures | |  | No “golden parachute” excise tax gross ups |  | Align our executive compensation structure with the interests of our stockholders | | | |  | A majority of executive compensation is variable and is tied to the Company’s performance | | | |  | Retain an independent executive compensation consultant | | | |

LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 33 |

— | MAJOR ELEMENTS OF EXECUTIVE OFFICER COMPENSATION |

— MAJOR ELEMENTS OF NAMED EXECUTIVE OFFICER COMPENSATION The major elements of compensation for our named executive officers and details regarding how each component was determined in 2022 are described below. Base Salary Base salary levels for theour named executive officers are set forth in their respective employment agreements. The base salary amounts were determined at the time we entered into the various employment agreements based on each individual’s professional experience and scope of responsibilities within our organization, compensation levels for others holding similar positions in other organizations and compensation levels for senior executives at the Company. Short-termShort-Term Incentives

(Annual Cash Bonus) For 2020,2022, our named executive officers were eligible for short-term performance-based cash incentives under their employment agreements, subject to the Company’s Executive Cash Incentive Plan. The Executive Cash Incentive Plan establishes a program of short-term incentive compensation awards for executive officers and other key executives that is directly related to our performance results. For more information about short-term incentive awards, see “Executive Compensation and Other Information — Employment Agreements.” Predetermined performance targets are used to establish the annual cash incentives for our named executive officers and are comprised of the Company’s adjusted property EBITDA, as adjusted for certain discretionary items deemed appropriate by the Compensation Committee. For Messrs. Adelson, Goldstein, Dumont and Hudson, the Compensation Committee determined the 2020 EBITDA-based performance target to be based on the Company’s consolidated adjusted property EBITDA for the year ended December 31, 2020, adjusted to add back corporate expense and exclude the Management Incentive Program (described below) bonus accrual. Adjusted property EBITDA is used to measure the operating performance of our properties compared to those of our competitors. This metric establishes our ability to pay dividends, support the continued investment in our existing properties and future development projects, and our ability to return capital to stockholders through our share repurchase program.

The Compensation Committee may subsequently approve additional discretionary items to be taken into account when determining the actual performance achieved during the period for purposes of determining the financial achievement percentage of the predetermined EBITDA-based performance targets. When determining the 2020 actual EBITDA-based performance for Messrs. Adelson, Goldstein, Dumont and Hudson, the Compensation Committee approved adjustments for the impact of certain variances in table games’ win percentages (hold normalization) and foreign exchange rate fluctuations between the U.S. dollar and Singapore dollar.

In determining the 2020 EBITDA-based performance targets, the Compensation Committee’s goal was to set an aggressive objective based on its review of the annual budget information provided by management and the Board’s discussions with our executive officers and management about the assumptions underlying the 2020 budget and the Company’s operating and development plans for 2020. The Compensation Committee believes the achievement of the 2020 performance target required Messrs. Adelson, Goldstein, Dumont and Hudson to perform at a high level to earn the target bonus payment.

The Compensation Committee established a 2020 predetermined EBITDA-based performance target for Messrs. Adelson, Goldstein, Dumont and Hudson of $4.66 billion. Due to the impact of the COVID-19 Pandemic, the Company did not achieve the minimum predetermined EBITDA-based performance targets. As a result, no annual cash incentive bonus payments were made to our named executive officers for 2020.

Long-Term Incentives (Annual Equity Awards) Mr. Adelson Under his amended employment agreement,Goldstein, Mr. Adelson was eligible to receive an annual cash incentive bonus contingent on the Company’s achievement of annual performance targets that are EBITDA-based.Dumont, Mr. Adelson’s annual cash bonus ranged from $0 (if the Company achieved less than 85% of the predetermined EBITDA-based performance target) to a maximum 250% of his annual base salary (if the Company achieved 100% or greater of the predetermined EBITDA-based performance target) (the “Maximum Bonus”). If the Company achieved 85% of the EBITDA target,Hyzak and Mr. Adelson’s annual cash bonus would have been 20% of the Maximum Bonus and the amount of the annual cash bonus would have been determined using straight line interpolation of achievement between 85% and 100% of the EBITDA-based performance target.

Messrs. Goldstein, Dumont and Hudson

Under their employment agreements, Messrs. Goldstein, Dumont and Hudson are eligible to receive discretionary bonuses under the Company’s Management Incentive Program, subject to the Executive Cash Incentive Plan. The Management Incentive Program, which has been implemented by the Compensation Committee pursuant to the Company’s Executive Cash Incentive Plan, is the Company’s bonus program whose participants also include many of the Company’s Team Members.

Under the Company’s 2020 Management Incentive Program, the Company must achieve at least 90% of the predetermined EBITDA-based performance target in order for Messrs. Goldstein, Dumont and Hudson to be eligible to receive annual bonuses. Their bonus payment amounts can be up to 100% of their respective target awards.

LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 34 |

Long-term Incentives (Equity Awards)

Mr. Adelson was and Messrs. Goldstein, Dumont and Hudson are eligible for long-term equity incentives under the Company’sour Amended and Restated 2004 Equity Award Plan, which is administered by the Compensation Committee and was created to allow us to attract, retain and motivate Team Members and to enable us to provide incentives directly related to increases in our stockholder value. Mr. Adelson was entitled under his amended employment agreement to an annual stock option grant to purchase shares of the Company’s Common Stock in accordance with the Amended and Restated 2004 Equity Award Plan. The employment agreements for Messrs.Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson provided for sign-on equity incentive awards but did notin the form of restricted stock units and also provide for subsequent or annual grants of equity incentive awards.awards in the form of restricted stock units subject to meeting performance criteria set by the Compensation Committee. The Compensation Committee however, is authorized to award such grants in its sole discretion. Providingbelieves that providing such long-term equity incentives:

aligns our executive officers’ long-term interest with those of our stockholders;

| • | | aligns our executive officers’ long-term interest with those of our stockholders by incentivizing management to continue to grow our business in ways that drive stock price appreciation over the long term; |

ensures focus on building and sustaining stockholder value; and

| • | | ensures focus on building and sustaining stockholder value; and |

| • | | promotes retention of our executive officers. |

For more information about equity incentive awards,long-term incentives, see “— Executive Compensation Related Policies and Practices — Grant Practices for Stock Options, Restricted Stock and Restricted Stock Units” and “Executive Compensation and Other Information — Employment Agreements.” Grants made during 2020 are included in the 2020 Grants of Plan-Based Awards Table. | | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 31 |

Personal Benefits We provide all of our eligible Team Members with a wide array ofpersonal benefits so that they can focus on performing their duties and responsibilities for the Company, which include: Healthcare: medical/prescription, dental, vision, short-term disability, life and accidental death and disability insurance options at no premium cost; group healthcare insurance, free flu vaccinations, health screening and other support for both physical and mental health;

| • | | Healthcare: medical/prescription, dental, vision, short-term disability, life and accidental death and disability insurance options at no premium cost; group healthcare insurance; and other support for both physical and mental health, such as a free Employee Assistance Program for employees and their household at SCL, which provides information regarding nutrition, disease management, stress reduction and injury prevention; |

Retirement benefits: retirement planning schemes, which may include contributions from the employer, as well as the Team Member;

| • | | Retirement benefits: retirement planning programs, which may include contributions from the Team Member as well as matching from the employer (the matching element was suspended throughout the COVID-19 Pandemic, but was reinstituted in the third quarter of 2022); |

Subsidized child care programs, including access to onsite centers in Las Vegas;

| • | | Subsidized child care programs; |

Paid parental leave for new parents in Singapore and Macao;

| • | | Paid parental leave for new parents; |

Tuition reimbursement on certain educational expenses;

| • | | Training and development: through Sands Academy, our global training and development platform, we provide courses, learning tools, coaching opportunities and one-on-one consulting to help employees fulfill their potential, as well as provide tuition reimbursement; and |

On-site provision of meals; and

Coverage of all COVID-19 testing and treatment under all of the Company’s medical plans at no cost to the Team Members and their dependents.

| • | | On-site provision of meals. |

In addition to the health, welfare and retirement programs generally available to all of our eligible Team Members, we provide our named executive officers with certain other personal benefits, each of which the Compensation Committee believes are reasonable and in the best interest of the Company and our stockholders, including: participating in a supplemental medical expense reimbursement program;

| • | | participating in a supplemental medical expense reimbursement program (in which other members of senior management—but not all Team Members—also participate); |

utilization of Company personnel, facilities and services on a limited basis, subject to the receipt of appropriate approvals and reimbursement to the Company; and

| • | | utilization of Company personnel, facilities and services on a limited basis, subject to the receipt of appropriate approvals and reimbursement to the Company; and |

use of Company-owned aircraft for business purposes,| • | | use of Company-owned aircraft for business and personal travel, subject to appropriate approvals. |

We also pay for the cost of security services for Mr. Adelson and his immediate family membersGoldstein and Mr. Goldstein.Dumont. These security measures were provided for the benefit of the Company and based on the advice of an independent security consultant. We do not consider such security costs to be personal benefits since these costs arise from the nature of Mr. Goldstein and Mr. Dumont’s role within the Company. However, the SEC rules require security costs to be reported as personal benefits. In connection with the aforementioned security concerns, Messrs. Adelson andMr. Goldstein and theirhis spouse, and Mr. Dumont and his immediate family members utilize, Company ownedas described herein, Company-owned or managed-managed aircraft for personal travel. Mr. Goldstein recognizesand Mr. Dumont recognize taxable income for any personal aircraft usage by himMr. Goldstein or his spouse, and by Mr. Dumont and his immediate family, members,respectively, for which heeach receives a tax reimbursement from the Company for such personal aircraft usage. The Company did not pay for or incur any costs for the use of aircraft by Mr. Adelson or his family for personal travel in 2020. In October 2018, the Compensation Committee approved certain medical support services be provided to Mr. Adelson at the cost of the Company. Mr. Adelson recognized imputed taxable income for these medical services. Refer to “Employment Agreements” for additional details on eligible perquisites for each of our named executive officers under their respective employment agreements, and “Executive Compensation and Other Information — All Other Compensation” for the cost of providing such perquisites during 2020.2022. 2022 Executive Compensation Performance Criteria As described above in “— The Process of Setting Executive Compensation,” Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson each have an employment agreement with the Company that provides the overall framework for compensation, and the Compensation Committee pre-determines performance targets within that framework for an applicable year in order to establish the annual short-term (cash) and long-term (equity) incentives. In determining the 2022 performance targets, the Compensation Committee’s goal was to set aggressive objectives based on its review of the annual budget information provided by management and the Board’s discussions with our named executive officers and management about the assumptions underlying the 2022 budget and the Company’s operating and development plans for 2022. The Compensation Committee believes that achievement of the 2022 performance targets required Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson to perform at a high level to earn the target short- and long-term incentive payments. | | | | | | | | 32 | | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT2023 Proxy Statement | 35 |

|

COMPENSATION DISCUSSION AND ANALYSIS For 2022, the Compensation Committee set the performance targets as follows: | • | | Extension or renewal of the Macao concession |

| • | | Continued progress on U.S. based development opportunities |

| • | | Advancement of digital business initiatives |

| • | | Balance sheet and liquidity management in a pandemic operating environment |

| • | | Substantial progress on our MBS renovation program |

| • | | LVS consolidated adjusted property EBITDA increase of 20% over 2021 level of $786 million |

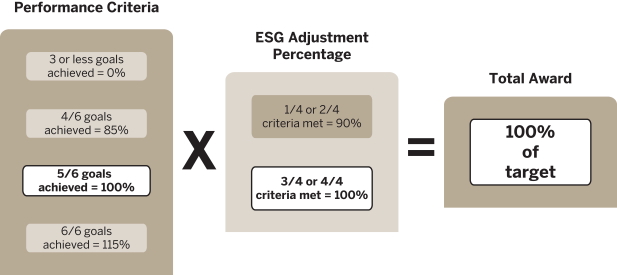

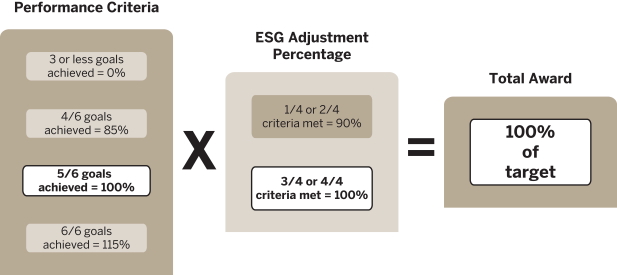

Pursuant to each of our named executive officer’s employment agreements and as further established by the Compensation Committee, if four of these performance criteria are met, the annual short- and long-term incentives are at 85% of target; if five of these performance criteria are met, the annual short- and long-term incentives are at 100% of target; and if six of these performance criteria are met, the annual short- and long-term incentives are at 115% of target. If three or fewer of these performance criteria are met, the annual short- and long-term incentives are not provided. Additionally, for 2022, the Compensation Committee established an ESG adjustment factor whereby if at least three out of four of the below metrics were met, the annual short- and long-term incentives would be paid at the level earned pursuant to the Company’s performance against the metrics discussed above, and if less than three of the below metrics were met, the annual short- and long-term incentives would be adjusted to 90% of the level earned pursuant to the Company’s performance metrics discussed above. For 2022, the Compensation Committee set the ESG metrics as follows: | • | | Annual ESG reporting to the Board |

| • | | Demonstration of progress in decreasing carbon emissions in line with five-year target in 2021 - 2025 period |

| • | | Expansion of Sands Cares Accelerator in Asia; transition of Sands Cares in U.S. |

| • | | Recognition on three global, regional or national ESG related indices or listings |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 33 |

The 2022 performance criteria were achieved and awarded as follows: | | | | | | | | | Short-term Performance-based Cash Incentive Targets | | | | | | TARGET | | RATIONALE | | ACHIEVEMENT STATUS | | ACHIEVEMENT DETAILS | | | | | | Extension or renewal of Macao concession | | Macao has historically generated the largest cash flow for us | | Achieved | | Concession awarded in December 2022 | | | | | | Continued progress on U.S. based development opportunities | | Integrated Resort development in key growth markets in the U.S. is a priority for us | | Achieved | | We made substantial progress on work needed to prepare for a potential license application in New York | | | | | | Advancement of digital business initiatives | | Digital initiatives in specific products and markets is a development opportunity for us | | Achieved | | Specific criteria for our digital initiatives were certified as achieved by the Board | | | | | | Balance sheet and liquidity management in pandemic operating environment | | Balance sheet and liquidity management during the COVID-19 Pandemic is key to the Company’s ability to continue to drive value for our stockholders | | Achieved | | We attained liquidity of $8.79 billion as of December 31, 2022 | | | | | | Substantial progress on MBS renovation program | | Continuing to maintain and expand the iconic Marina Bay Sands drives revenue and provides value to our shareholders | | Achieved | | We made substantial progress on renovations for existing property and plans for future expansion | | | | | | LVS consolidated adjusted property EBITDA increase of 20% over 2021 level of $786 million | | Consolidated adjusted property EBITDA establishes our ability to support the continued investment in our existing properties and future development projects and to return capital to stockholders | | Not achieved | | $732 million consolidated adjusted property EBITDA for 2022 due to the pandemic-related reduction in travel and tourism spending in Macao |

| | 5 out of 6 metrics achieved for a payout at 100% of target |

| | | | | | | | 34 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

Employment Agreements in Place during 2020

COMPENSATION DISCUSSION AND ANALYSIS Messrs. Adelson,

| | | | | | | | ESG Metrics: | | | | | | TARGET | | RATIONALE | | ACHIEVEMENT STATUS | | ACHIEVEMENT DETAILS | | | | | | Annual ESG reporting to Board | | Board oversight of ESG matters is important to good governance | | Achieved | | Board, via the Nominating and Governance Committee, considers ESG matters quarterly | | | | | | Demonstration of progress in decreasing carbon emissions in line with five-year target in 2021 - 2025 period | | Carbon emission decrease is one of the Company’s critical environmental targets | | Achieved | | We achieved a greenhouse gas emission reduction of 50% from the baseline year | | | | | | Expansion of Sands Cares Accelerator in Asia; transition of Sands Cares in U.S. | | Long-term investment in the communities in which we operate | | Achieved | | We added a new member in Macao that started the Accelerator program in 2022 and in connection with the Las Vegas sale and new integrated resort opportunities in New York and Texas adjusted our Sands Cares focus in the U.S. | | | | | | Recognition on three global, regional or national ESG related indices or listings | | Objective measure of the standard to which our ESG program is performing | | Achieved | | Named to the DJSI World for the third consecutive year and DJSI North America for the fifth consecutive year in 2022 Included in the FTSE4Good Index Series Recognized by Newsweek as one of America’s Most Responsible Companies Included on the Drucker Institute’s list of the 250 best-managed publicly traded companies, the only IR development or gaming company to be recognized |

| | 4 out of 4 ESG metrics achieved for an adjustment factor of 100% |

| | Short- and long-term incentives awarded at 100% of target |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 35 |

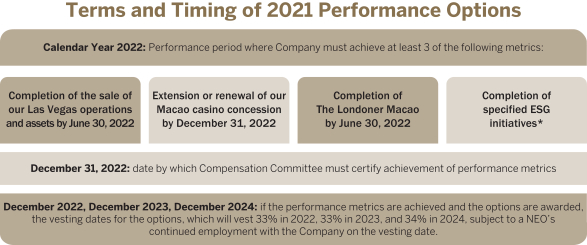

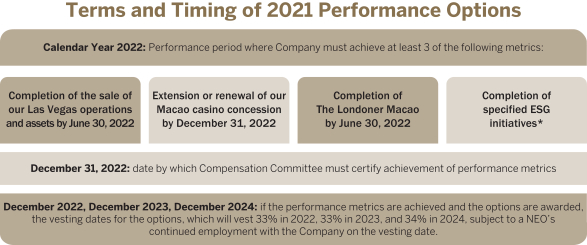

Achievement of 2021 Performance Options In December 2021, in order to further align the compensation of our named executive officers to the accomplishment of long-term operating objectives and after considering input from Korn Ferry (the Compensation Committee’s independent compensation consultant), the Compensation Committee granted performance-based stock options (the “2021 Performance Options”) to Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson. Our named executive officers did not receive any payouts under our management incentive program for either 2020 or 2021 in connection with the impact of the global pandemic. The 2021 Performance Options terms and conditions are as follows:

| | | | | | | * Obtaining LEED certification of our new standalone Las Vegas corporate offices; completion of a review of our hiring and compensation practices; and completion of the identification and definition of diversity, equity and inclusion principles for our SCL and MBS subsidiaries. | | |

In December 2022, the Compensation Committee certified the achievement of 3 out of 4 performance criteria as follows, resulting in the achievement of the award: | | | | | | | | | | | | TARGET | | RATIONALE | | ACHIEVEMENT STATUS | | ACHIEVEMENT DETAILS | | | | | | Completion of the sale of our Las Vegas operations and assets by June 30, 2022 | | Key driver of liquidity | | Achieved | | Sale closed February 23, 2022 | | | | | | Extension or renewal of our Macao casino concession by December 31, 2022 | | Continuation of key gaming operations in Macao | | Achieved | | Concession awarded December 16, 2022 | | | | | | Completion of The Londoner Macao by June 30, 2022 | | Improving the asset base in a key market | | Achieved | | The Londoner Macao completed by June 30, 2022 | | | | | Completion of a review of our hiring and compensation practices Completion of the identification and definition of diversity, equity and inclusion principles for our SCL and MBS subsidiaries LEED certification of our new standalone Las Vegas corporate offices | | We believe a focus on ESG is important to our overall success | | Partially Achieved | | Review of our hiring and compensation practices completed December 21, 2022 Identification and definition work completed December 21, 2022 Las Vegas corporate offices not completed by December 31, 2022 |

| | | 3 out of 4 criteria achieved, resulting in the certification of the 2021 Performance Options |

Upon certain limited qualifying terminations of employment (i.e., termination without cause or for good reason), any unvested options will remain outstanding and eligible to vest. To avoid windfall scenarios, the performance-based stock options do not contain retirement protections and always require satisfaction of the performance objectives. | | | | | | | | 36 | | LAS VEGAS SANDS 2023 Proxy Statement | |

|

COMPENSATION DISCUSSION AND ANALYSIS Employment Agreements Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson are employed pursuant to multi-year employment agreements that reflect the individual negotiations with each of them. We use multi-year employment agreements to foster retention and succession planning, to be competitive and to protect the business with restrictive covenants, such as non-competition, non-solicitation and confidentiality provisions. The employment agreements provide for severance pay in the event of the involuntary termination of the executive’s employment without cause (or, where applicable, termination for good reason), which allows these executives to remain focused on the Company’s interests and, where applicable, serves as consideration for the restrictive covenants in their employment agreements. | | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 37 |

Employment agreement terms and compensation for our executive officers are summarized as follows: MR. ADELSON | | | | | MR. GOLDSTEIN | | | Employment

Agreement

Term | | •Originally effective as of December 20, 2004 • Amended employment agreement effective as of January 1, 2017

• Mr. Adelson’s death on January 11, 2021 was a termination event

The Compensation Committee believed amending his employment agreement was in the best interests of the Company and its stockholders and, based on discussions with AETHOS, the terms of Mr. Adelson’s amended employment agreement were fair to the Company.

| Salary | | Mr. Adelson’s base salary in 2020 was $5,000,000 and remained unchanged from 2019. | Short-Term

Incentive | | Under his amended employment agreement, Mr. Adelson was eligible to receive an annual cash incentive bonus contingent on the Company’s achievement of annual performance targets that are EBITDA-based. Mr. Adelson’s annual cash bonus ranged from $0 (if the Company achieved less than 85% of the predetermined EBITDA-based performance target) to a maximum 250% of his annual base salary (if the Company achieved 100% or greater of the predetermined EBITDA-based performance target) (the “Maximum Bonus”). If the Company achieved 85% of the EBITDA target, Mr. Adelson’s annual cash bonus would have been 20% of the Maximum Bonus and the amount of the annual cash bonus would have been determined using straight line interpolation of achievement between 85% and 100% of the EBITDA-based performance target.

Due to the impact of the COVID-19 Pandemic, the Company did not achieve the minimum predetermined EBITDA-based performance targets for 2020. As a result, Mr. Adelson did not receive a bonus for 2020.

| Long-Term

Incentive | | Under his amended employment agreement, Mr. Adelson was entitled to receive an annual equity incentive award with a total grant value of $1,000,000. The equity incentive award value was granted in the form of stock options, the number of which was determined based on the grant date Black-Scholes value of the award.

On January 31, 2020, Mr. Adelson received the 2020 grant of options to purchase 132,625 shares of our Common Stock, based on the Black-Scholes value of the stock option award on the grant date.

| Personal

Benefits* | | Mr. Adelson was entitled to:

• Reimbursement up to $200,000 annually for personal legal and financial planning fees and expenses under his amended employment agreement.

• During the term of his employment, full-time and exclusive use of an automobile and a driver of his choice and the use of a Boeing Business Jet for his and his companions’ travel in connection with Company business.

• Pursuant to his amended employment agreement and the advice of an independent security consultant, security services for himself, his wife and his children, until the age of 22. Pursuant to its consideration of appropriate circumstances, the Compensation Committee approved in January 2020 a one-year extension of security services for one of the children.

• Medical support services to Mr. Adelson provided by the Company, the cost of which is considered taxable income to Mr. Adelson. Such services were approved by the Compensation Committee in January 2020.

The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Adelson was generally required to reimburse the Company in full for these services, except that in 2020, Mr. Adelson was permitted to make use of certain of the Company’s hotel suites at a reduced rate for which he was not required to reimburse the Company but the value of which was recognized as taxable income.

Mr. Adelson participated in a group supplemental medical insurance program available to certain of our senior officers.

|

LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 36 |

MR. GOLDSTEIN | Employment

Agreement

Term | | • Originally effective as of January 1, 2015

• Amended on November 20, 2018 and effective as of January 1, 2020

• Terminates on December 31, 2024

The Compensation Committee considered factors including Mr. Goldstein’s performance as the Company’s President and Chief Operating Officer, his tenure at the Company, his business experience and knowledge of the gaming industry and the Chief Executive Officer’s recommendations when approving Mr. Goldstein’s amended employment agreement.

| Salary | | Mr. Goldstein’s base salary in 2020 was $4,500,000, an increase of $1,100,000 from 2019, pursuant to his amended employment agreement entered into on November 20, 2018. | Short-Term

Incentive | | Under his amended employment agreement, Mr. Goldstein has a target bonus opportunity of 100% of his base salary, or $4,500,000, subject to his achievement of performance criteria established by the Compensation Committee.

Due to the impact of the COVID-19 Pandemic, the Company did not achieve the minimum predetermined EBITDA-based performance targets for 2020. As a result, Mr. Goldstein did not receive a bonus for 2020.

| Long-Term

Incentive | | Mr. Goldstein did not receive any equity grants in 2020. | Personal

Benefits*

| | Mr. Goldstein is entitled to:

• Security services and utilization of Company owned jet aircraft for business and personal purposes, for the benefit of the Company at the Company’s expense, and pursuant to the advice of an independent security consultant and the approval of the Compensation Committee.

• At his election, first class travel on commercial airlines for all business trips and first class hotel accommodations.

• A country club membership. Mr. Goldstein reimburses the Company in full for any personal use of this membership.

The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Goldstein is required to reimburse the Company in full for these services.

Mr. Goldstein participates in a group supplemental medical insurance program available to certain of our senior officers.

|

MR. DUMONT | Employment

Agreement

Term | | • Effective as of January 1, 2016

• Terminated on December 31, 2020

The Compensation Committee considered factors including Mr. Dumont’s finance background and experience with the Company when approving his employment agreement.

| Salary | | Mr. Dumont’s base salary in 2020 was $1,200,000 and remained unchanged from 2019. | Short-Term Incentive | | Under his employment agreement, Mr. Dumont has a target bonus opportunity of 100% of his base salary, or $1,200,000, subject to his achievement of performance criteria established by the Compensation Committee.

Due to the impact of the COVID-19 Pandemic, the Company did not achieve the minimum predetermined EBITDA-based performance targets for 2020. As a result, Mr. Dumont did not receive a bonus for 2020.

| Long-Term Incentive | | Mr. Dumont did not receive any equity grants in 2020. | Personal Benefits* | | The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Dumont is required to reimburse the Company in full for these services.

Mr. Dumont participates in a group supplemental medical insurance program available to certain of our senior officers.

|

LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 37 |

MR. HUDSON | Employment

Agreement

Term | | • Effective as of September 30, 2019

• Terminates on October 1, 2022

The Compensation Committee considered factors including Mr. Hudson’s extensive legal background and experience when approving his employment agreement.

| Salary | | Mr. Hudson’s base salary in 2020 was $850,000 through July 22, 2020 and $950,000 thereafter. | Short-Term

Incentive | | Under his employment agreement, Mr. Hudson has a target bonus opportunity of 100% of his prorated base salary, or $894,100, subject to his achievement of performance criteria established by the Compensation Committee.

Due to the impact of the COVID-19 Pandemic, the Company did not achieve the minimum predetermined EBITDA-based performance targets for 2020. As a result, Mr. Hudson did not receive a bonus for 2020.

| Long-Term

Incentive | | Mr. Hudson did not receive any equity grants in 2020. | Personal

Benefits* | | The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Hudson is required to reimburse the Company in full for these services.

Mr. Hudson participates in a group supplemental medical insurance program available to certain of our senior officers.

|

| • | The Compensation Committee believes providing these benefits to our executives is appropriate as it facilitates our executives’ performance of their duties. | | • | For more information, see footnote (3) to the 2020 Summary Compensation Table under “Executive Compensation and Other Information.” |

LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 38 |

New Employment Agreements Implemented in March 2021

In March 2021, we entered into new or amended employment agreements with each of Messrs. Goldstein, Dumont, Hyzak and Hudson. Changes to the executive officers, and their role and title (except for Mr. Hudson) reflect the implementation of the previous discussed succession plan earlier this year. The new employment agreements were implemented to reflect: (i) new roles and responsibilities for certain executives, and (ii) stockholder feedback regarding certain components of our previous employment agreements.

MR. GOLDSTEIN | Employment

Agreement

Term | | • Effective as of January 26, 2021

•Terminates on March 1, 2026 The Compensation Committee considered factors including Mr. Goldstein’s position as the Company’s Chief Executive Officer, his tenure at the Company, his business experience and knowledge of the gamingCompany’s industry, as well as recommendations and advice from theKorn Ferry (the Compensation Committee’s independent compensation consultant,consultant), and, based on these factors and discussions with Korn Ferry, the Compensation Committee determined that the terms of Mr. Goldstein’s new employment agreement were fair to the Company. | | | | Salary | | Mr. Goldstein’s base salary is $3,000,000, pursuant to his employment agreement. Mr. Goldstein’s base salary was decreased from $4,500,000 prior to his entry into the employment agreement to $3,000,000 as part of our effort to ensure that most of his compensation should be “at-risk.” | | | Short-Term

Incentive | | Under his employment agreement, Mr. Goldstein has a target bonus opportunity of 200% of his base salary, or $6,000,000, subject to his achievement of performance criteria established by the Compensation Committee. The bonus is payable at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The actual bonus payout is determined by the Compensation Committee. In 2022, the performance criteria were certified at 100%, and as a result, Mr. Goldstein received a bonus of $6 million. See “— 2022 Executive Compensation Performance Criteria.” | | | Long-Term

Incentive | | Mr. Goldstein received a one-time initial award of 150,000 restricted stock units (“RSU”s) in connection with his employment agreement. These initial RSUs will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. Under his employment agreement, Mr. Goldstein has a target annual equity award opportunity equal to 325% of his base salary, or $9,750,000, subject to his achievement of performance criteria established by the Compensation Committee. The annual equity award will be granted at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The annual equity award will be paid in the form of RSUs that will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. In addition,The performance criteria for the 2022 RSU award were certified at 100%, and as a result, Mr. Goldstein receives a one-time initialreceived an RSU award of 150,000 RSUs. These initial RSUs will$9.75 million. See “— 2022 Executive Compensation Performance Criteria.”

On December 3, 2021, Mr. Goldstein received options to purchase 2,000,000 shares of our Common Stock that vest ratably on each of the firstannually over three anniversaries of the grant date,years, subject to histhe satisfaction of certain performance objectives by December 31, 2022, which the Compensation Committee certified as of December 31, 2022. See “— Achievement of 2021 Performance Award.” The continued vesting of these options is subject to Mr. Goldstein’s continued employment as ofwith the applicable vesting date.Company. | | | Personal

Benefits* Benefits* | | Mr. Goldstein is entitled to: •Security services and utilization of Company ownedCompany-owned jet aircraft for business and personal purposes for the benefit of the Company at the Company’s expense, and pursuant to the advice of an independent security consultant and the approval of the Compensation Committee. •At his election, first class travel on commercial airlines for all business trips and first class hotel accommodations. •Mr. Goldstein is eligible to receive an income tax gross up for the foregoing benefits if they are determined to be taxable income to him. The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Goldstein is required to reimburse the Company in full for these services. Mr. Goldstein participates in a group supplemental medical insurance program available to certain of our senior officers. |

| | | | | | | | 38 | | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 39 |

MR. DUMONT | Employment

Agreement

Term2023 Proxy Statement | |

|

COMPENSATION DISCUSSION AND ANALYSIS | | | | | MR. DUMONT | | | Employment

Agreement

Term | | •Effective as of January 26, 2021 •Terminates on March 1, 2026 The Compensation Committee considered factors including Mr. Dumont’s position as the Company’s President and Chief Operating Officer, his tenure at the Company, his business experience and knowledge of the gamingCompany’s industry, as well as recommendations and advice from the independent compensation consultant,Korn Ferry, and, based on these factors and discussions with Korn Ferry, the Compensation Committee determined that the terms of Mr. Dumont’s new employment agreement were fair to the Company. | | | | Salary | | Mr. Dumont’s base salary is $2,500,000, pursuant to his employment agreement. Mr. Dumont’s annual base salary was increased from $1,200,000 prior to his entry into the employment agreement to $2,500,000 to reflect his increased level of seniority and responsibility. | | | Short-Term

Incentive | | Under his employment agreement, Mr. Dumont has a target bonus opportunity of 200% of his base salary, or $5,000,000, subject to his achievement of performance criteria established by the Compensation Committee. The bonus is payable at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The actual bonus payout is determined by the Compensation Committee after consultation with the Company’s Chief Executive Officer. In 2022, the performance criteria were certified at 100%, and as a result, Mr. Dumont received a bonus of $5 million. See “— 2022 Executive Compensation Performance Criteria.” | | | Long-Term

Incentive | | Mr. Dumont received a one-time initial award of RSUs in an amount equal to 200% of his base salary, or $5,000,000, in connection with his employment agreement. These initial RSUs will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. Under his employment agreement, Mr. Dumont has a target annual equity award opportunity equal to 200% of his base salary, or $5,000,000, subject to his achievement of performance criteria established by the Compensation Committee. The annual equity award will be granted at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The annual equity award will be paid in the form of RSUs that will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. In addition,The performance criteria for the 2022 RSU award were certified at 100%, and as a result, Mr. Dumont receives a one-time initialreceived an RSU award of RSUs in an amount equal$5 million. See “— 2022 Executive Compensation Performance Criteria.”

On December 3, 2021, Mr. Dumont received options to 200%purchase 1,500,000 shares of his base salary, or $5,000,000. These initial RSUs willour Common Stock that vest ratably on each of the firstannually over three anniversaries of the grant date,years, subject to histhe satisfaction of certain performance objectives by December 31, 2022, which the Compensation Committee certified as of December 31, 2022. See “— Achievement of 2021 Performance Award.” The continued vesting of these options is subject to Mr. Dumont’s continued employment as ofwith the applicable vesting date.Company. | | | Personal

Benefits* | | Mr. Dumont is entitled to: •Security services and utilization of Company ownedCompany-owned jet aircraft for business and personal purposes, for the benefit of the Company at the Company’s expense, and pursuant to the advice of an independent security consultant and the approval of the Compensation Committee. •At his election, first class travel on commercial airlines for all business trips and first class hotel accommodations. •Mr. Dumont is eligible to receive an income tax gross up for the foregoing benefits if they are determined to be taxable income to him. The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Dumont is required to reimburse the Company in full for these services. Mr. Dumont participates in a group supplemental medical insurance program available to certain of our senior officers. |

| | | | | | | |

| | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 40 |

MR. HYZAK | Employment

Agreement

Term2023 Proxy Statement | | 39 |

| | | | | MR. HYZAK | | | Employment

Agreement

Term | | •Effective as of January 26, 2021 •Terminates on March 1, 2026 The Compensation Committee considered factors including Mr. Hyzak’s finance background and experience with the Company, as well as recommendations and advice from the independent compensation consultant,Korn Ferry, when approving his employment agreement, and, based on these factors and discussions with Korn Ferry, the Compensation Committee determined that the terms of Mr. Hyzak’s new employment agreement were fair to the Company. | | | | Salary | | Mr. Hyzak’s base salary is $1,200,000, pursuant to his employment agreement. | | | Short-Term

Incentive | | Under his employment agreement, Mr. Hyzak has a target bonus opportunity of 125% of his base salary, or $1,500,000, subject to his achievement of performance criteria recommended by the Chief Executive Officer and established by the Compensation Committee. The bonus is payable at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The actual bonus payout is determined by the Compensation Committee after consultation with the Company’s Chief Executive Officer. In 2022, the performance criteria were certified at 100%, and as a result, Mr. Hyzak received a bonus of $1.5 million. See “— 2022 Executive Compensation Performance Criteria.” | | | Long-Term

Incentive | | Mr. Hyzak received a one-time initial award of RSUs in an amount equal to 125% of his base salary, or $1,500,000, in connection with his employment agreement. These initial RSUs will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. Under his employment agreement, Mr. Hyzak has a target annual equity award opportunity equal to 125% of his base salary, or $1,500,000, subject to his achievement of performance criteria established by the Compensation Committee. The annual equity award will be granted at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The annual equity award will be paid in the form of RSUs that will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. In addition,The performance criteria for the 2022 RSU award were certified at 100%, and as a result, Mr. Hyzak receives a one-time initialreceived an RSU award of RSUs in an amount equal$1.5 million. See “— 2022 Executive Compensation Performance Criteria.”

On December 3, 2021, Mr. Hyzak received options to 125%purchase 500,000 shares of his base salary, or $1,500,000. These initial RSUs willour Common Stock that vest ratably on each of the firstannually over three anniversaries of the grant date,years, subject to histhe satisfaction of certain performance objectives by December 31, 2022, which the Compensation Committee certified as of December 31, 2022. See “— Achievement of 2021 Performance Award.” The vesting of these options is subject to Mr. Hyzak’s continued employment as ofwith the applicable vesting date.Company. | | | Personal

Benefits* | | The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Hyzak is required to reimburse the Company in full for these services. Mr. Hyzak participates in a group supplemental medical insurance program available to certain of our senior officers. |

| | | | | | | | 40 | | LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 41 |

MR. HUDSON | Employment

Agreement

Term2023 Proxy Statement | |

|

COMPENSATION DISCUSSION AND ANALYSIS | | | | | MR. HUDSON | | | Employment

Agreement

Term | | •Originally effective as of September 30, 2019 •Amended effective March 1, 2021 •Terminates on March 1, 2026 The Compensation Committee considered factors including Mr. Hudson’s extensive legal background and experience, as well as recommendations and advice from the independent compensation consultant,Korn Ferry, when approving his amended employment agreement, and, based on these factors and discussions with Korn Ferry, the Compensation Committee determined that the terms of Mr. Hudson’s amended employment agreement were fair to the Company. | | | | Salary | | Mr. Hudson’s base salary is $1,100,000, pursuant to his amended employment agreement. | | | Short-Term

Incentive | | Under his amended employment agreement, Mr. Hudson has a target bonus opportunity of 125% of his base salary, or $1,375,000, subject to his achievement of performance criteria recommended by the Chief Executive Officer and established by the Compensation Committee. The bonus is payable at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The actual bonus payout is determined by the Compensation Committee after consultation with the Company’s Chief Executive Officer. In 2022, the performance criteria were certified at 100%, and as a result, Mr. Hudson received a bonus of $1.38 million. See “— 2022 Executive Compensation Performance Criteria.” | | | Long-Term

Incentive | | Mr. Hudson received a one-time initial award of RSUs in an amount equal to 125% of his base salary, or $1,375,000, in connection with his employment agreement. These initial RSUs will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. Under his amended employment agreement, Mr. Hudson has a target annual equity award opportunity equal to 125% of his base salary, or $1,375,000, subject to his achievement of performance criteria established by the Compensation Committee. The annual equity award will be granted at 85% of target if the performance criteria are achieved at the threshold payout level, and will not exceed 115% of target if the performance criteria are achieved at the maximum payout level. The annual equity award will be paid in the form of RSUs that will vest ratably on each of the first three anniversaries of the grant date, subject to his continued employment as of the applicable vesting date. In addition,The performance criteria for the 2022 RSU award were certified at 100%, and as a result, Mr. Hudson receives a one-time initialreceived an RSU award of RSUs in an amount equal$1.38 million. See “— 2022 Executive Compensation Performance Criteria.”

On December 3, 2021, Mr. Hudson received options to 125%purchase 500,000 shares of his base salary, or $1,375,000. These initial RSUs willour Common Stock that vest ratably on each of the firstannually over three anniversaries of the grant date,years, subject to histhe satisfaction of certain performance objectives by December 31, 2022, which the Compensation Committee certified as of December 31, 2022. See “— Achievement of 2021 Performance Award.” The vesting of these options is subject to Mr. Hudson’s continued employment as ofwith the applicable vesting date.Company. | | | Personal

Benefits* | | The personal use of Company personnel, facilities and services on a limited basis and subject to the receipt of appropriate approvals. Mr. Hudson is required to reimburse the Company in full for these services. Mr. Hudson participates in a group supplemental medical insurance program available to certain of our senior officers. |

| • | | The Compensation Committee believes providing these benefits to our executives is appropriate as it facilitates our executives’ performance of their duties. |

| • | | For more information, see footnote (3) to the 2022 Summary Compensation Table under “Executive Compensation and Other Information.” |

| | | | | | | |

| | LAS VEGAS SANDS 2023 Proxy Statement | | 41 |

Change in Control and Termination Payments The employment agreements with Messrs. Adelson,Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson provide for payments and the continuation of benefits upon certain terminations of employment, including for Messrs. Adelson, Goldstein and Dumont,upon certain terminations of employment within two years following a change in control of the Company. Mr. Adelson’s employment agreement allowed him to voluntarily terminate his employment at any time during the one-year period following a change in control. Mr. Goldstein’s and Mr. Dumont’s employment agreements provide the executive may voluntarily terminate his employment agreement upon 30 days’ and 90 days’ written notice, respectively, following a change in control, provided that his termination of employment may not be effective until twelve months following the change in control. In addition, the employment agreements with Messrs. Adelson,Mr. Goldstein, Mr. Dumont, Mr. Hyzak and Mr. Hudson include restrictive covenants relating to future employment. The Compensation Committee believes thethat eligibility to receive post-termination payments provideprovides important retention incentives during what can be an uncertain time for executives. TheyThe eligibility to receive such payments also provideprovides executives with additional monetary motivation to focus on and complete a transaction that theour Board believes is in the best interests of our stockholders rather than to seek new employment opportunities. Under their employment agreements, if any payments to our named executive officers are subject to the excise tax imposed by Section 4999 of the Internal Revenue Code (the “Code”), the payments that are considered to be “parachute payments” will be limited to the greatest amount that can be paid without causing any excise tax to be applied to the executive or loss of deduction to the Company,but only if,by reason of such reduction,the net after-tax benefit to them (as defined in their employment agreement) exceeds the net after-tax benefit if the reduction were not made. The Company’sOur Amended and Restated 2004 Equity Award Plan was originally established in 2004.2004 and amended most recently in 2019. The purpose of the plan is to provide a means through which the Company may attract able persons to enter and remain in the employ of the Company. The change in control provisions of the plan were designed in furtherance of this goal.

Further information about benefits upon certain terminations of employment (including following a change in control) are described under “Executive Compensation and Other Information — Potential Payments Upon Termination or Change in Control.” LAS VEGAS SANDS CORP. • 2021 PROXY STATEMENT | 42 |

— | TAX AND ACCOUNTING CONSIDERATIONS RELATING TO EXECUTIVE COMPENSATION |